Yin Luo and the Top-Ranked QES team have spent the last 25+ years developing numerous datafeeds that are based on our vast factor libraries. The Global Factor Library contains over 3,500 proprietary factors that utilizes point-in-time data to form the raw ingredients and inputs into our quantitative models. Unlike most conventional quantitative techniques, our models deliver superior alpha even in a highly concentrated portfolio.

Our models are uncorrelated to traditional investment process; therefore, fundamental and discretionary managers can incorporate our models to supplement their existing investment process. Further, Our research focuses on alternative Big Data and machine learning. We strive to identify new and innovative ideas. Most quantitative investors should find our models uncorrelated to their existing strategies.

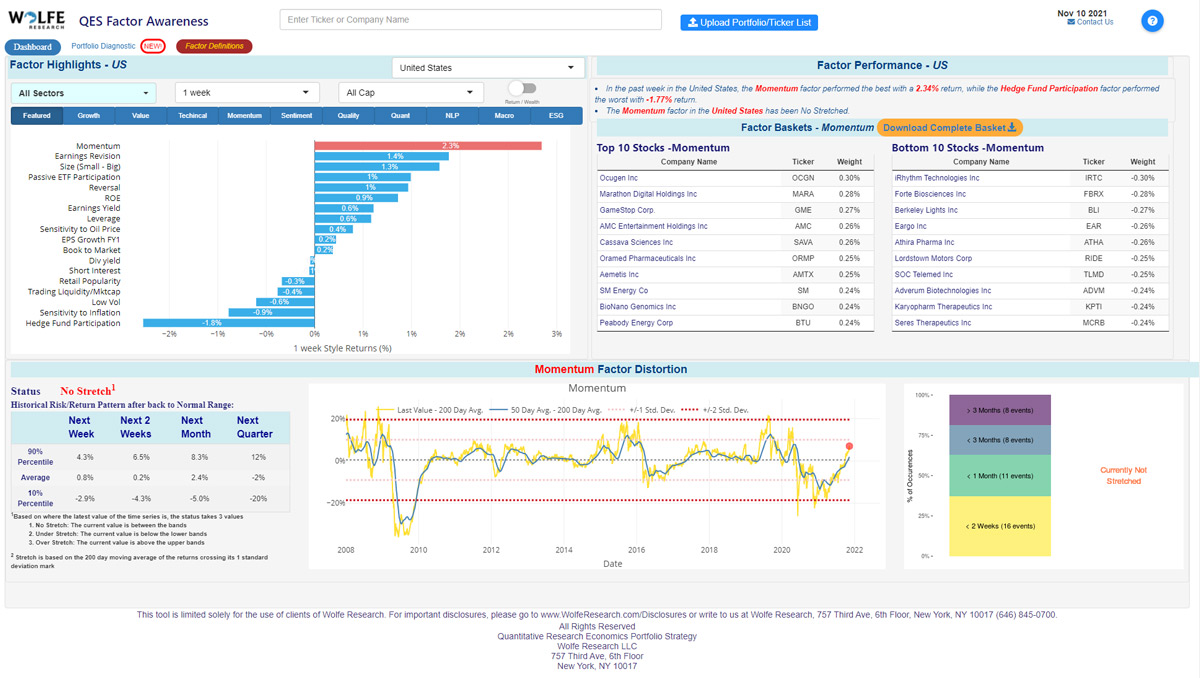

QES Factor Awareness

The Factor Awareness Dashboard is a real time sector & stock-specific tool that allows investment managers to upload a portfolio/interest list, monitor associated factor exposures, view individual stocks contributing to elevated factor risk, toggle single stock factor exposures, and assess the impact of a factor unwind on their portfolio. Clients can select from 11,000+ equity securities, 60+ benchmark indices, and 1,200 ETFs globally to include into their portfolios

Newest Features of the Dashboard:

Intraday Factor Performance: view performance of 100+ risk & alpha factors intraday, at a minute-by-minute frequency – particularly useful on days with rapid market movement often triggered by economic, political, and/or pandemic news releases.

Sector Risk Models: we introduce six sector specific risk models – Energy, Consumer, TMT, Health Care, Industrials & Materials, and Financials. Risk factors included in each are grouped into five categories: fundamental, technical, alternative, macro, & positioning/crowding

Investable Strategies & Baskets: In recent years, we have launched multiple investable strategies and baskets (e.g., the cybersecurity, pricing power, inflation, MALTA, SHIELD, and socially conscious baskets detailed in Autonomous Thematic Investing). Clients can view the performance, factor exposures, expected risk, and stock constituents of these baskets.

Comprehensive Portfolio Reporting Tool: Upgraded to include intuitive charts, detailed metrics on both factor and company exposures, and a multitude of risk metrics. Portfolio reports can also be downloaded in Excel or PDF.

Our team specializes in the following data feeds…

Our Team

The QES team has been working at the forefront of the systematic revolution for 20+ years. Many members of our team have spent their entire careers together, and the QES team now has over 20 dedicated quantitative researchers across the world. The team has specialists in every aspect of quantitative research, from alternative data, factor construction, machine learning/NLP, stock-selection model, ESG, and global macro, we strive to address the needs of quantitative and fundamental investors alike. As the quantitative investment landscape continues to evolve, rest assured that the Wolfe QES team will continue to innovate on all fronts.